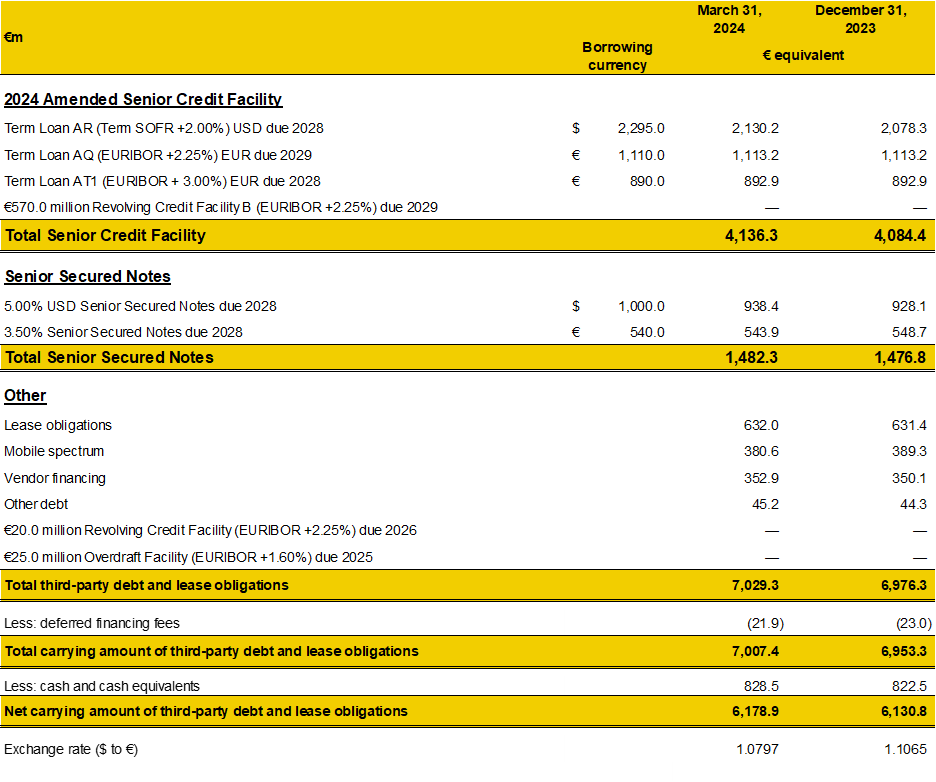

Debt Profile

The following table details our consolidated third-party debt, lease obligations and cash and cash equivalents. The borrowing currency figures reported below reflect the principal amount of the debt instrument in the borrowing currency, while the euro equivalent figures include interest accrued on the respective obligations.

At March 31, 2024, our blended fully-swapped debt borrowing cost was 3.8% (December 31, 2023: 3.8%) and the average tenor of our third-party debt was approximately 4.3 years (December 31, 2023: 4.6 years) with no debt repayments, excluding shorter-term liabilities under our vendor financing program, prior to March 2028.

For additional information, we refer to our Q1 2024 earnings release.