Outlook

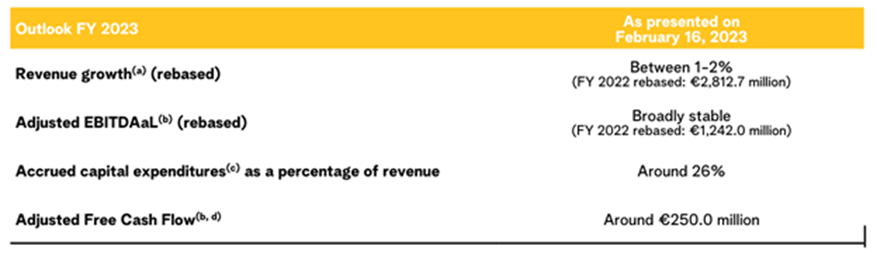

Having completed the first six months of the year and looking ahead to the second half, we remain on track to deliver on our financial objectives as presented mid-February. The rebased revenue and Adjusted EBITDAaL growth rates presented below do not yet include the benefits of the Wyre transaction with Fluvius which closed on July 1, 2023. This mainly affects our FY 2022 rebased Adjusted EBITDAaL given the removal of the Fluvius lease payment as from the closing date.

Our FY 2023 outlook includes rebased top line growth between 1-2% and a broadly stable Adjusted EBITDAaL compared to last year. On the investment side, we continue to target a CAPEX/sales ratio of around 26% as we continue to see (i) higher spending on, amongst others, our 5G roll-out, (ii) targeted fiber deployments and trench sharing opportunities as in 2022 and (iii) preparatory investments in IT and product development to prepare for the launch in Wallonia in early 2024. And finally, we continue to target for FY 2023 an Adjusted Free Cash Flow of around €250.0 million. With that, our dividend floor of €1.0 per share (gross), or €108.6 million in aggregate, remains well covered.

(a) On a reported basis, our expected revenue growth for the full year 2023 would be between 7% and 8%.

(b) Quantitative reconciliations to net profit (including net profit growth rates) and cash flows from operating activities for our Adjusted EBITDAaL and Adjusted Free Cash Flow guidance cannot be provided without unreasonable efforts as we do not forecast (i) certain non-cash charges including depreciation and amortization and impairment, restructuring and other operating items included in net profit, nor (ii) specific changes in working capital that impact cash flows from operating activities. The items we do not forecast may vary significantly from period to period.

(c) Excluding the recognition of the capitalized football broadcasting rights and mobile spectrum licenses and excluding the impact from certain lease-related capital additions on our accrued capital expenditures.

(d) Excluding payments on mobile spectrum licenses acquired as part of the 2022 multiband spectrum auction, and assuming the tax payment on our 2022 tax return will not occur until early 2024.